Dynamic Nonparametric Clustering of Multivariate Panel Data

2022

with Julia Schaumburg, André Lucas and Bernd Schwaab.

Published at the Journal of Financial Econometrics.

Python code available on Github.

Also a Tinbergen Institute discussion paper No. 21-040/III and ECB Working Paper No. 2577.

Formely entitled Clustering dynamics and persistence for financial multivariate panel data.

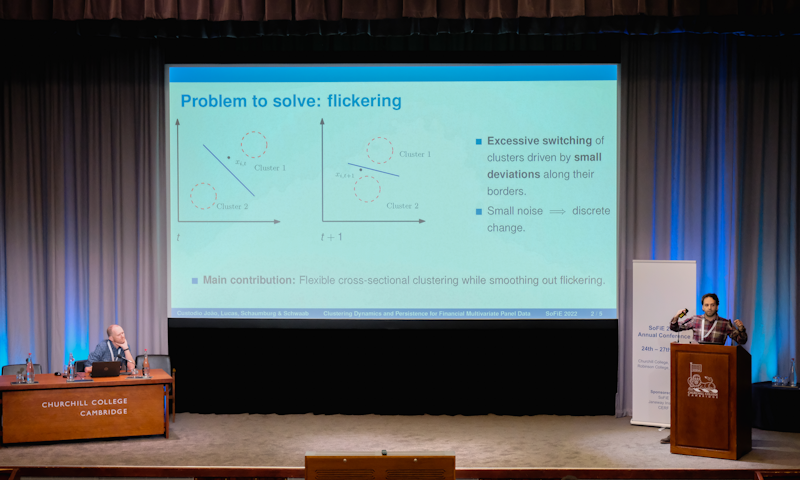

We introduce a new dynamic clustering method for multivariate panel data characterized by time-variation in cluster locations and shapes, cluster compositions, and possibly the number of clusters. To avoid overly frequent cluster switching (flickering), we extend standard cross-sectional clustering techniques with a penalty that shrinks observations toward the current center of their previous cluster assignment. This links consecutive cross-sections in the panel together, substantially reduces flickering, and enhances the economic interpretability of the outcome. We choose the shrinkage parameter in a data-driven way and study its misclassification properties theoretically as well as in several challenging simulation settings. The method is illustrated using a multivariate panel of four accounting ratios for 28 large European insurance firms between 2010 and 2020.